- The Leaders Leverage

- Posts

- Fraud automation boosts security for middle-market firms.

Fraud automation boosts security for middle-market firms.

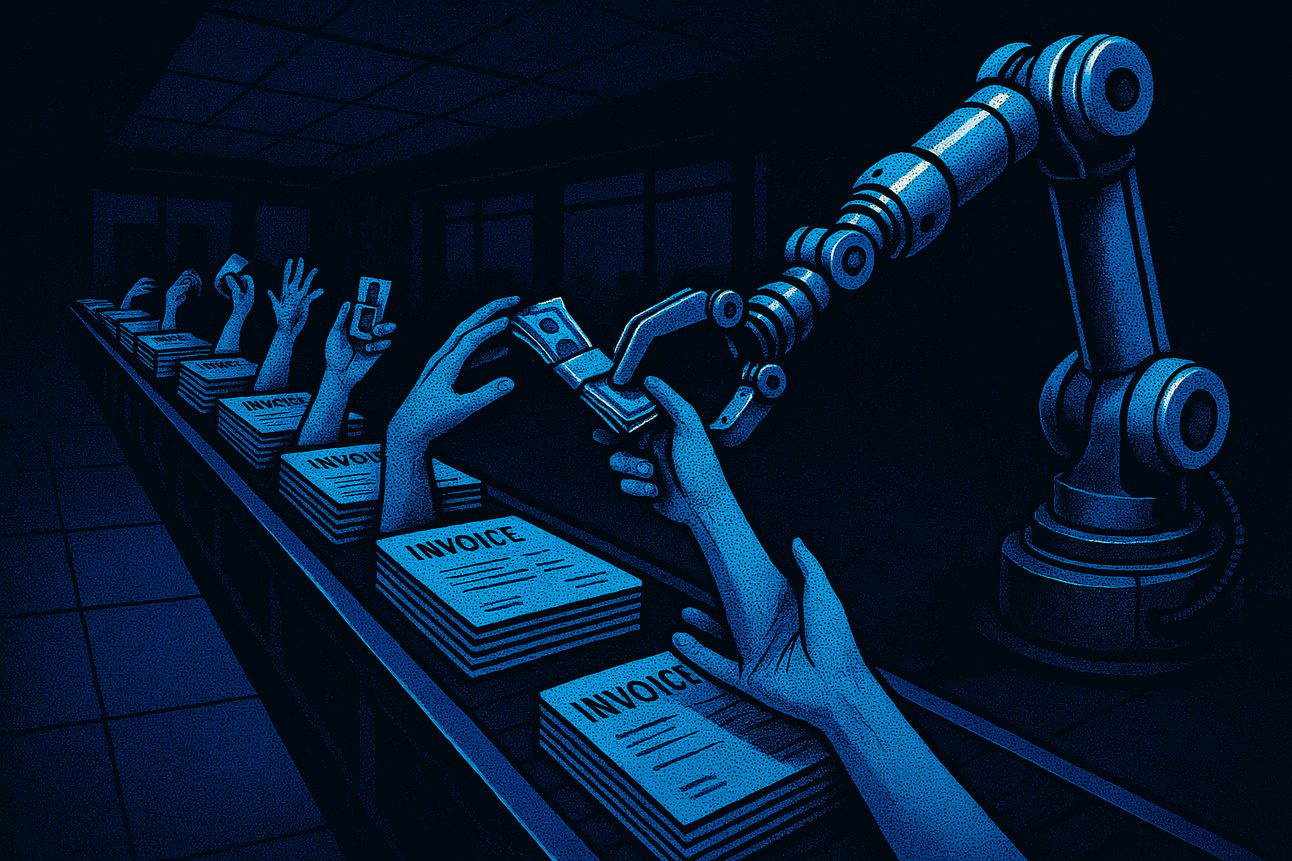

Beating Procurement Fraud with Automation Before It Breaks Your Bottom Line

For middle-market firms already stretched by economic uncertainty, procurement fraud is more than a compliance headache, it’s a silent profit killer.

The latest data shows that automation isn’t just helpful in fraud detection, it’s transformational. And yet, most companies are still relying on training and outdated controls.

👉 Today’s Issue:

Why middle-market firms are bleeding revenue from undetected fraud

Automation adoption is low, but effectiveness is proven.

What proactive companies are doing differently

AI News

➔ Featured Story

🤖Fraud in the Procure-to-Pay Cycle Hits Middle-Market Firms Hard — Fraud Prevention Automation Can Give an Edge

PYMNTS (Feb 2025)

New research from PYMNTS Intelligence reveals that 87% of firms operating under high uncertainty suffer losses from fraud, but only 28% are using automation to stop it.

Despite limited effectiveness, manual approaches like staff training (50%) and internal controls (53%) remain the dominant fraud prevention tactics. Meanwhile, automation doubles the likelihood of reducing fraud, but adoption remains sluggish.

Key Points:

71% of firms identify automation as the most effective fraud prevention strategy

87% of high-uncertainty firms report customer loss due to fraud

82% say procurement fraud has caused direct financial losses

22% identify third-party fraud as their top concern

Internal errors and payment processing issues further compound the risks

Why It Matters: This isn’t just about catching fraud. It’s about restoring operational bandwidth.

Manual fraud detection is reactive, error-prone, and hard to scale. In contrast, automation creates a real-time compliance layer, flagging anomalies, validating transactions, and streamlining due diligence across the procurement chain.

Firms that delay this transition will face compounding financial, reputational, and strategic costs. As economic uncertainty grows, the cost of inaction increases. Automation is no longer a “nice to have” in risk mitigation; it’s a competitive moat.

➔ Other Notable AI News

Stripe launches real-time anti-fraud models for B2B vendors

Aimed at invoice-level validation and vendor screening

👉 Stripe BlogRamp announces AI-driven spend protection tools for mid-market CFOs

Includes duplicate invoice detection and dynamic limits

👉 TechCrunchSAP adds LLM-powered fraud insights to S/4HANA Cloud Suite

Helps detect abnormal procurement patterns using historical spend

👉 SAP Newsroom

That's it for today!

Before you go we’d love to know what you thought of today's newsletter to help us improve The The Leader’s Leverage experience for you.

See you soon,

James Brooks—The Leader’s Leverage editorial team

Reply